In today’s Washington Post, Rabbi Jill Jacobs, executive director of T’ruah: The Rabbinic Call for Human Rights reveals how U.S. taxpayers are subsidizing donations to far-right organizations in Israel that openly promote the extremist teachings of the late Meir Kahane.

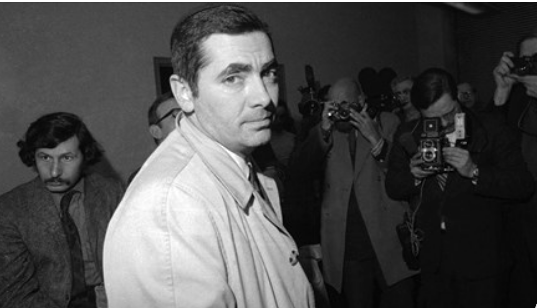

A U.S.-born rabbi who was assassinated in 1990, Kahane advocated for the forced expulsion of Palestinians from territory controlled by Israel and encouraged violent terrorism against those he viewed as enemies of Israel. Kahane’s Kach party and Kahane Chai, an organization founded in his memory, were both outlawed in Israel in 1994, and both organizations have been on the U.S. State Department list of Foreign Terrorist Organizations since 1997.

Yet Kahane’s views are celebrated at the Jerusalem Heritage House, where portraits of Kahane are displayed and young visitors are offered literature by and about him. The hostel’s director regularly posts tributes and videos about Kahane on his Facebook page, concluding one post with a Hebrew abbreviation meaning “May God avenge his blood,” often invoked as a call for vigilantism.

Jerusalem Heritage House, along with other Kahane-revering institutions, receive millions of dollars in funding from American Jewish charities that enjoy tax-exempt status. As Rabbi Jacobs notes in The Washington Post: “American taxpayers are subsidizing the radicalization of hostel guests — primarily young American backpackers.”

T’ruah in August filed a complaint with the Internal Revenue Service against three Jewish charities that support Heritage House and other Israeli organizations espousing Kahane’s ideology. The Heritage House is supported heavily by Jewish Heritage Movement, a Staten Island-based tax-exempt organization. Two other organizations also fund Kahanist groups: American Friends of Yeshivat HaRaayon HaYehudi (the “Jewish idea” yeshiva), an educational institution founded by Kahane that promotes his videos and writings; and the Central Fund of Israel, which supports organizations led by Kahane proteges committed to carrying out his legacy. These include Honenu, which makes cash payments to Israelis convicted of terrorism and to their families; and Hemla, which aims to “save” Jewish women from mixing with Palestinians.

T’ruah calls on the Internal Revenue Service to revoke these groups’ tax-exempt status because the dollars raised benefit far-right Jewish terrorist groups in Israel. The IRS has acknowledged receipt of our complaint, though per law, cannot disclose whether an investigation has been initiated.

Organizations are ineligible for tax-exempt status if the income or assets they disburse are used for illegal or terrorist activities.

This is not the first time T’ruah has spoken out against American Jewish organizations that support far-right Israeli terrorism with tax-deductible contributions. In 2016, the IRS investigated Central Fund of Israel’s funding of Honenu in response to a complaint by T’ruah. Funding has subsequently been resumed.

“Those of us who support Israel often complain about the Palestinian Authority’s payments to families of terrorists, including some who carried out horrific and fatal attacks on Israeli citizens,” Rabbi Jacobs writes in the Post. “We must speak just as loudly against the funding of terrorism and incitement by Israeli extremists, especially when American taxpayers finance these activities through subsidies of tax-exempt organizations.”

T’ruah: The Rabbinic Call for Human Rights mobilizes a network of more than 2,000 rabbis and cantors from all streams of Judaism that, together with the Jewish community, act on the Jewish imperative to respect and advance the human rights of all people. Grounded in Torah and our Jewish historical experience and guided by the Universal Declaration of Human Rights, we call upon Jews to assert Jewish values by raising our voices and taking concrete steps to protect and expand human rights in North America, Israel, and the occupied Palestinian territories.

To learn more or to speak with Rabbi Jill Jacobs, contact Julie Wiener at jwiener@truah.org or call 917-655-4586.